Transitioning to ISSB standards marks a pivotal moment for companies in Singapore striving to enhance sustainability reporting and align with global ESG expectations. Understanding these standards is especially important, as the Singapore Exchange (SGX) is making it mandatory for listed companies to publish sustainability reports aligned with the ISSB framework.

This guide provides a clear roadmap for navigating the shift, ensuring compliance while unlocking long-term value through transparent and consistent sustainability reporting.

What is ISSB?

The ISSB was established in 2021 by the IFRS Foundation to develop comprehensive, globally applicable sustainability disclosure standards. Its goal is to provide investors and financial markets with consistent, high-quality information on sustainability-related risks and opportunities.

Unlike previous frameworks that varied in scope and application, the ISSB consolidates key initiatives such as the Climate Disclosure Standards Board (CDSB) and the Value Reporting Foundation (which included SASB and Integrated Reporting). By doing so, it offers a unified structure that supports transparency and comparability across jurisdictions and industries.

Why use ISSB Standards?

There are several compelling reasons why businesses, including those not obligated to publish sustainability reports yet, should consider adopting ISSB standards:

- Global Consistency: ISSB standards are to environmental reporting what IFRS is to accounting. ISSB serves as a single baseline that aligns with international investor expectations and regulatory frameworks.

- Investor Confidence: Clear, comparable ESG disclosures increase trust among stakeholders and attract sustainability-focused capital.

- Efficiency and Clarity: By consolidating overlapping frameworks, ISSB reduces duplication and simplifies the reporting process for multinational companies. This will allow for consistency in the information provided and enable real comparison between branches of a company in different countries.

The ISSB Standards: IFRS S1 and IFRS S2

In 2023, ISSB released its two foundational standards – IFRS S1 and IFRS S2. Together, they form the core of the sustainability reporting framework.

IFRS S1: General Requirements for Sustainability-related Financial Disclosures

IFRS S1 sets out the overarching principles for sustainability reporting. It requires companies to disclose information about all sustainability-related risks and opportunities that could reasonably be expected to be material. This includes any activity that can affect cash flow, access to finance and the cost of capital.

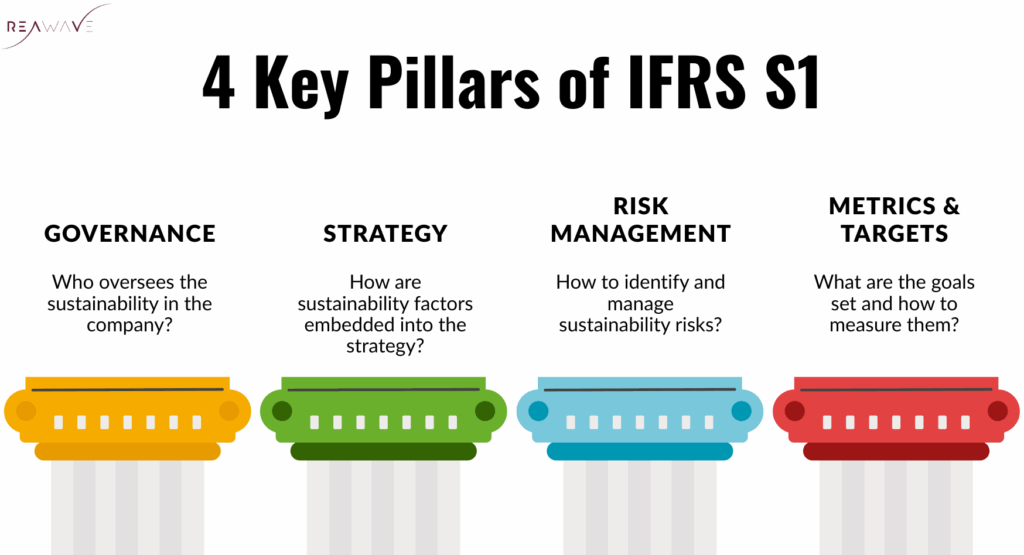

These ISSB standards are structured around 4 key pillars:

- Governance – Who oversees the sustainability in your company?

- Strategy – How are sustainability factors embedded into your strategy?

- Risk Management – How do you identify and manage sustainability risks?

- Metrics and Targets – What goals have you set and how are you measuring them?

IFRS S1 also informs us about some critical requirements for how and when sustainability information should be reported. These are:

- Scope – The sustainability reports should cover the same entities as the financial reports.

- Timing – Sustainability reports should be published at the same time as the financial reports and for the same reporting period.

- Comparative Information – Companies must include prior data to allow for comparison. (Omission of this is allowed in the first year of reporting)

- Placement of Disclosures – The sustainability report should be part of the general financial report, should be clearly identifiable and not mixed be mixed with irrelevant information.

- Compliance Statement – A full compliance statement with the IFRS Sustainability Disclosure Standards is mandatory. Partial compliance is not allowed.

ISSB S2: Climate Related Disclosures

IFRS S2 builds on the TCFD framework and focuses specifically on climate-related risks and opportunities.

IFRS S2 divides risks into two categories:

- Physical Risks – These include any risks a company faces due to climate change like floods, wildfires, and draughts.

- Transition Risks – These are risk that arise as a company shifts to a lower carbon economy.

IFRS S2 also outlines the opportunities that should be disclosed:

- Innovation – For example, investing in clean and renewable technology.

- Sustainable Practices – For example, adopting regenerative agriculture.

- New Markets – For example, entering into carbon credit trading or green finance.

As for the structure of the report, it is the same as IFRS S1. That is, it requires disclosures across governance, strategy, risk management, and metrics/targets.

How is ISSB S2 Different?

What sets IFRS S2 apart:

- It mandates disclosures of Scope 1, Scope 2, and (where relevant) Scope 3 greenhouse gas emissions.

- It introduces industry-specific metrics based on SASB Standards.

- It encourages scenario analysis to assess climate resilience.

- Companies must outline transition plans, including how they intend to achieve climate targets.

Transitioning to ISSB: Key Considerations

While the ISSB standards are designed for broad applicability, transitioning to them requires strategic planning and internal alignment. Here are key steps companies should consider:

- Conduct a materiality assessment to identify the sustainability-related risks and opportunities that are most relevant to financial performance.

- Evaluate current disclosures to determine gaps between existing ESG reports (e.g., TCFD or GRI) and ISSB requirements.

- Map existing frameworks (especially TCFD-aligned disclosures) to IFRS S1 and S2 structures. Many organizations will find an overlap which should ease the transition.

- Establish cross-functional governance, involving finance, sustainability, risk, and legal teams to ensure accurate and integrated reporting.

- Develop data systems and controls for collecting, verifying, and monitoring ESG data in line with financial reporting standards.

The ISSB has provided a Transition Implementation Guide to help companies phase in reporting practices and build readiness over time.

Key Points to Keep in Mind While Transitioning to ISSB

Not a separate report: ISSB disclosures are meant to be integrated into general-purpose financial reports.

Investor-focused lens: Unlike GRI, which takes a double-materiality approach, ISSB focuses specifically on information relevant to investors.

Industry-specific expectations: The inclusion of SASB metrics means reporting requirements may differ significantly across sectors.

Singapore relevance: The Accounting and Corporate Regulatory Authority (ACRA) and SGX are exploring ISSB adoption, making early preparation beneficial for compliance and reputation.

The introduction of ISSB standards marks a significant step toward globally consistent and investor-relevant sustainability reporting. As regulatory bodies, move to align disclosure requirements with IFRS S1 and S2, companies that act early will be better prepared for compliance, stakeholder trust, and long-term growth.

By adopting ISSB standards now, organizations can simplify reporting, reduce duplication, and align sustainability strategy with financial performance. For auditing firms and advisors, this transition also presents a critical opportunity to support clients through change and help them embed ESG into core business practices.