In today’s business landscape, sustainability is no longer optional – it’s a strategic imperative. As stakeholders increasingly demand transparency around environmental, social, and governance (ESG) practices, companies are turning to sustainability reporting frameworks and standards to communicate their impact and performance. However, navigating this space can be overwhelming due to the sheer number of frameworks and guidelines available.

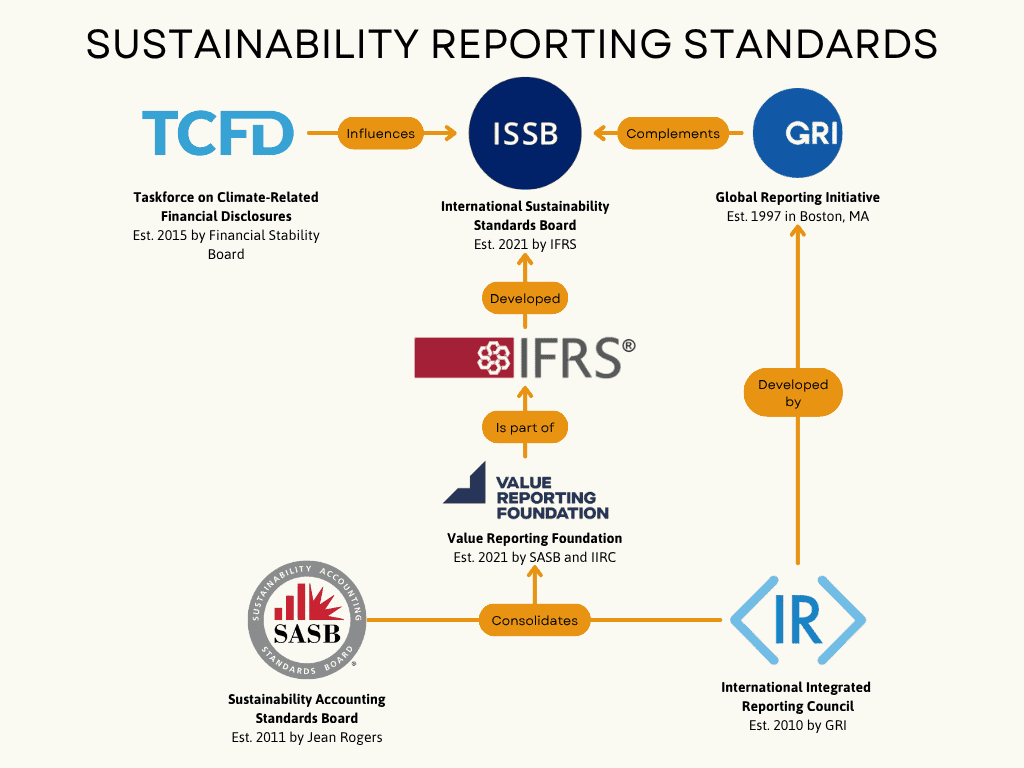

From global initiatives like the Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) to emerging unified approaches such as the International Sustainability Standards Board (ISSB) under IFRS, businesses are faced with multiple choices.

This blog aims to provide a comparison of sustainability reporting frameworks and offer guidance on selecting a standard that aligns with your organization’s size, sector, and sustainability goals.

Why Are There So Many Sustainability Reporting Standards?

There are so many sustainability reporting frameworks and standards because different groups have different needs. Some standards focus on what investors care about, while others look at a company’s broader impact on society and the environment.

Over time, new standards were created to respond to specific issues, like climate change, industry-specific risks, or regional laws. For example, some standards are used globally, while others are designed to meet local regulations, like those in the European Union.

While this variety can be confusing, it also gives companies the flexibility to choose what works best for their goals, size, and audience. Efforts are now being made to bring more consistency and alignment across these standards.

The Top 7 Global Sustainability Reporting Frameworks & Standards

EU CSRD (ESRS)

While there are many sustainability reporting frameworks and standards around the world, the following are the most widely used standards that you should know about.

What is CSRD?

The EU Corporate Sustainability Reporting Directive (CSRD) is a major regulation introduced by the European Commission to enhance the quality and scope of sustainability reporting within the European Union. It replaces the earlier Non-Financial Reporting Directive (NFRD) and significantly expands both the number of companies required to report and the depth of information disclosed.

The CSRD aims to ensure that businesses provide clear, consistent, and comparable data on environmental, social, and governance (ESG) issues.

To support this, it introduced the European Sustainability Reporting Standards (ESRS), developed by EFRAG (European Financial Reporting Advisory Group). These standards set detailed guidance on what companies must report, including climate risks, human rights, and social impacts.

Who does this effect?

These reporting requirements are mandatory for the businesses operating in the EU that meet certain thresholds.

You can learn more about CSRD and CS3D on their dedicated blogs.

ISSB (IFRS Sustainability Disclosure Standards)

What is ISSB?

The International Sustainability Standards Board (ISSB) was established by the IFRS Foundation in 2021 to create a baseline for global sustainability frameworks. It was developed in response to the growing demand for more consistent and comparable ESG information across markets.

The ISSB aims to help investors understand how sustainability issues affect a company’s financial position and prospects. Its standards are focused on financial materiality, that is disclosing only what is relevant to enterprise value. In 2023, the ISSB released its first two standards:

- IFRS S1: General requirements for sustainability-related disclosures

- IFRS S2: Climate-related disclosures (built on the TCFD framework)

Who does this effect?

As of now, adoption of the ISSB standards (IFRS S1 and S2) is voluntary, but many countries and regulators are starting to encourage or consider making them mandatory.

However, several jurisdictions, including Canada, the UK, Australia, Nigeria, New Zealand and Singapore, have announced intentions to make using sustainability reporting frameworks for businesses mandatory. Often the sustainability reporting frameworks are using ISSB as a baseline. Over time, adoption is expected to grow as demand for globally consistent ESG reporting increases.

The ISSB standards are designed for public and private companies that want to provide high-quality, investor-focused sustainability disclosures aligned with financial reporting. This marks ISSB one of the truly global sustainability frameworks.

If you want to learn more about the specific requirements for sustainability reporting for Australia, Singapore or New Zealand, you can visit their dedicated blogs.

Global Reporting Initiative (GRI)

What is GRI?

The Global Reporting Initiative (GRI) is one of the oldest and most widely used sustainability reporting frameworks in the world. It was established in the late 1990s by a U.S.-based nonprofit in partnership with the United Nations Environment Program (UNEP), with the goal of helping organizations report on their broader environmental, social, and economic impacts.

Unlike investor-focused standards like ISSB, the GRI framework is stakeholder-centric. It enables organizations to report on their impact on the environment, society, economy, and governance. Its modular structure consists of:

- Universal Standards (foundation and general disclosures),

- Sector Standards (industry-specific),

- Topic Standards (e.g., climate, tax)

Who does this effect?

GRI is voluntary, but is widely adopted by:

- Large multinationals

- NGOs and public institutions

- Companies responding to stakeholder, customer, or supply chain pressure

- Organizations combining GRI with other standards like SASB or ESRS

Sustainability Accounting Standards Board (SASB)

What is SASB?

The Sustainability Accounting Standards Board (SASB) was founded in 2011 in San Francisco by Jean Rogers as an independent non-profit (501(c)(3)). Its mission is to develop industry-specific accounting standards for sustainability issues that significantly affect a company’s financial performance, such as cash flow, cost of capital, and financial condition.

SASB created standards for 77 industries, each including a focused set of quantitative and qualitative metrics to capture material ESG risks and opportunities. These metrics are designed for use by investors, lenders, and insurers in their financial analysis.

In August 2022, responsibility for SASB transitioned into the IFRS Foundation under the ISSB. The ISSB maintains and enhances the SASB Standards, integrating them as foundational materials within its global sustainability standards (IFRS S1 and S2).

Who does this effect?

Primarily public companies and financial community stakeholders, investors, analysts, and financial institutions that are seeking comparable, industry-tailored, financially material sustainability disclosures are effected by SASB.

It’s especially useful for organizations preparing under IFRS S1/S2, since SASB metrics support identification of relevant disclosures.

Task Force on Climate-related Financial Disclosures (TCFD)

What is TCFD?

It was tasked with developing a clear, voluntary framework for companies to disclose climate-related financial risks and opportunities to investors, lenders, and insurers.

In June 2017, TCFD published its official recommendations, structured around four pillars: Governance, Strategy, Risk Management, and Metrics & Targets. These recommendations include 11 core disclosures that organizations should incorporate into their mainstream financial filings to ensure transparency and comparability.

Over the years, these pillars have been adopted under many global sustainability frameworks.

Who does this effect?

While the standard is voluntary, it has been adopted under the ISSB and other standards. Thus any companies required to report under those standards need to follow the TCFD also.

International Integrated Reporting Council (IIRC) – IR Framework

What is IIRC or IR Framework?

The International Integrated Reporting Council (IIRC) was a global coalition of regulators, investors, companies, and academics that developed the Integrated Reporting (IR) Framework. The aim was to improve how businesses communicate their long-term value creation to stakeholders, moving beyond financial performance to include environmental, social, and governance (ESG) factors.

The IIRC promoted integrated thinking, encouraging companies to consider how their strategy, governance, performance, and prospects relate to the external environment and the resources they depend on. It didn’t replace financial or sustainability reports but sought to align them in a more cohesive and forward-looking format.

Who does this effect?

IIRC’s guidance was voluntary and primarily adopted by large public and multinational companies that wanted to lead in corporate transparency.

While not a compliance standard, IR gained traction with businesses seeking to better engage investors and long-term stakeholders by demonstrating resilience and purpose beyond profits.

However, it is worth noting that IIRC standards have been incorporated under many global sustainability frameworks like IFRS’s ISSB and thus, you may need to comply with the standards.

Value Reporting Foundation (VRF)

What is VRF?

The Value Reporting Foundation (VRF) was formed in 2021 through the merger of the IIRC and the SASB. The goal was to create a unified voice for international sustainability and value-based reporting standards, helping streamline global reporting frameworks.

The VRF combined SASB’s industry-specific metrics with the IIRC’s integrated thinking philosophy, offering tools and guidance that supported both financial and non-financial disclosure. It aimed to simplify the fragmented landscape of ESG reporting and provide a pathway toward consistency and comparability in sustainability reporting.

Who does this effect?

The VRF’s resources were used by companies worldwide, particularly by those operating in capital markets that demanded more robust ESG disclosures. It was especially relevant for organizations looking to enhance their sustainability reporting in a way that links ESG performance with financial outcomes.

How to Select a Sustainability Framework?

Choosing the right sustainability reporting standard depends on several factors, including your company’s location, size, industry, stakeholders, and reporting goals.

While some companies have the freedom to choose, others may not have a choice, as governments are making certain standards mandatory.

For example, companies operating in the EU are required to comply with the EU CSRD and ESRS, while Singapore requires companies to adopt ISSB and Australia requires AASB. Understanding local regulations is the first and most important step.

Next, consider your target audience. If your main focus is on investor transparency and financial materiality, standards like ISSB or SASB are well-suited. If your goal is broader impact reporting for all stakeholders, including employees, communities, and NGOs, GRI may be a better fit.

Lastly, if you have the freedom to choose any of the global sustainability frameworks, you should also consider your company’s resources and capability to fulfill the requirements of the reporting standard you are choosing.

To help make choosing easier, here is a chart of the different standards and how they interrelate.

As sustainability becomes a core part of business strategy, choosing the right reporting standard is more important than ever. While some companies may be guided by regulation, others must navigate multiple global sustainability frameworks to meet stakeholder expectations by themselves.

Understanding the purpose and audience of each standard, whether it’s ISSB, GRI, ESRS, or others, can help businesses report more effectively and build trust. The key is to stay informed, align with your business goals, and be transparent about your sustainability journey.