The OECD’s Pillar 2 global minimum tax framework marks a transformative step in international taxation, aimed at ensuring multinational enterprises pay a minimum tax rate of 15% on profits earned worldwide. This reform addresses base erosion and profit shifting, promoting fairer tax competition across jurisdictions.

This blog unpacks the core mechanisms of OECD Pillar 2 and highlights specific implementation details for France, Australia, New Zealand, and Singapore, offering essential insights for multinational companies preparing for these changes.

What is OECD Pillar 2 Global Minimum Tax?

The OECD (Organisation for Economic Co-operation and Development) Pillar 2 framework is a major part of the international global minimum tax initiative, developed to address the tax challenges of a highly digitalised and globalised economy. Its purpose is to curb base erosion and profit shifting (BEPS) by reducing harmful tax competition between jurisdictions.

Under OECD Pillar 2, large multinational enterprises (MNEs) must pay a minimum corporate tax rate of 15% on profits earned in each country where they operate. This applies regardless of where the company is headquartered.

If a business operates in a jurisdiction with a corporate tax rate below the OECD Pillar 2 minimum tax rate of 15%, other countries where it has operations can impose a “top-up” tax to meet the threshold. For example, if profits are taxed at 10% in one country, another jurisdiction can add a 5% tax to reach the global minimum rate.

Pillar 2 is one of two pillars in the OECD’s global tax reform:

- Pillar 1 reallocates taxing rights to reflect where business activities and profits occur.

- Pillar 2 enforces the minimum tax rate to prevent profit shifting to low-tax jurisdictions.

How does the Global Minimum Tax Work?

The OECD Pillar 2 rules are built around three core mechanisms designed to enforce the global minimum tax:

- Income Inclusion Rule (IIR) – If a multinational group’s effective tax rate (ETR) in any jurisdiction falls below the minimum 15%, the ultimate parent company must pay a top-up tax to bring the rate up to 15%.

- Undertaxed Profits Rule (UTPR) – This acts as a safeguard if the IIR is not applied. Under the UTPR, other group entities in different jurisdictions may be required to pay the top-up tax on low-taxed profits not covered by the IIR.

- Qualified Domestic Minimum Top-up Tax (QDMTT) – Many countries are introducing this domestic rule to keep taxing rights over low-taxed profits within their own jurisdiction. With a QDMTT, the country itself collects the additional tax, instead of it being paid to the parent entity’s country under the IIR or to another jurisdiction under the UTPR.

How does the Global Minimum Tax Apply?

The global minimum tax under OECD Pillar 2 generally applies to large multinational enterprise (MNE) groups with annual consolidated revenues of €750 million or more in at least two of the four preceding fiscal years.

It covers both domestic and cross-border operations, ensuring that qualifying groups pay a minimum effective tax rate of 15% in every jurisdiction where they operate.

Smaller businesses and purely domestic companies typically fall outside the scope, although local rules may still require compliance with certain reporting obligations.

How the Effective Tax Rate is Calculated

For all three rules, the calculation of the OECD Pillar 2 minimum tax rate uses a consistent approach. It blends current and deferred tax figures to determine the ETR, requiring a detailed understanding of both international tax principles and deferred tax accounting.

Together, these rules ensure that multinational enterprises operating in the countries adopting Pillar 2 cannot shift profits to low-tax jurisdictions without meeting the global 15% minimum threshold.

OECD Pillar 2 Effective Dates

The OECD Pillar 2 global minimum tax is being implemented in stages, and timelines vary between jurisdictions. Most countries have chosen to introduce the Income Inclusion Rule (IIR) and the Qualified Domestic Minimum Top-up Tax (QDMTT) first, with some early adopters legislating for application from 1 January 2024 (for accounting periods beginning on or after 31 December 2023).

Later in this blog, we provide specific implementation timelines and requirements for France, Australia, New Zealand, and Singapore.

What is the Tax Rule Multilateral Instrument (STTR MLI)?

Alongside the core OECD Pillar 2 rules, the Subject to Tax Rule Multilateral Instrument (STTR MLI) has been introduced to help implement the Pillar Two framework. This treaty-based rule allows source jurisdictions (the country where the payment originates) to impose additional tax on certain cross-border intragroup payments when those payments face a nominal corporate tax rate of less than 9% in the recipient’s jurisdiction.

The STTR MLI is particularly designed to benefit developing countries, enabling them to better protect their tax base by ensuring that certain payments, such as interest, royalties, and service fees, are taxed at a fair level.

A key feature of the STTR MLI is that it allows the STTR provisions to be incorporated directly into existing bilateral tax treaties without the need for lengthy renegotiations—provided that both treaty partners sign and ratify the instrument.

Currently, the STTR MLI is open for signature, but it remains to be seen how many jurisdictions will choose to adopt it.

How the Global Minimum Tax Impacts Companies

The introduction of the OECD Pillar 2 global minimum tax represents a significant shift in international tax planning and compliance for large multinational enterprises. Companies operating in low-tax jurisdictions may face higher overall tax liabilities due to the top-up tax mechanism, which ensures profits are taxed at a minimum rate of 15% regardless of where they are booked.

This change can influence how businesses structure their global operations, allocate profits, and choose investment locations. For many groups, it will require:

- Enhanced tax reporting and transparency to calculate the effective tax rate (ETR) for each jurisdiction.

- Adjustments to intra-group transactions and transfer pricing policies to avoid unintended top-up taxes.

- Greater alignment of tax and business strategies to ensure compliance without compromising competitiveness.

Reporting Obligations Under OECD Pillar 2 in France

Decree 2024-1126, effective from 6 December 2024, sets out detailed reporting requirements for companies in France subject to the OECD Pillar 2 global minimum tax.

Tax Return Disclosures

Constituent entities in France must indicate in their income tax return:

- Affiliation to a multinational or national group within Pillar 2 scope.

- Identity of the ultimate parent entity and the entity responsible for filing the information return.

- Jurisdiction of the reporting entity.

- Identity of the entity designated to file the top-up tax return.

GloBE Information Return (GIR)

The GIR comprises five statements providing information for calculating the global minimum tax and applying transitional safe harbours:

- Statement 1 – Identification details, group structure, constituent entities, exclusions, organisational changes, and a summary of global minimum tax application.

- Statement 2 – Data for applying temporary safeguard measures and identifying sub-groups per jurisdiction.

- Statement 3 – For each jurisdiction/sub-group: effective income tax rate (EIT), qualified result, covered taxes, and selected options.

- Statement 4 – For each entity (aggregated by tax group): type of return filed, qualified result, and covered taxes.

- Statement 5 – Jurisdiction-level data for calculating and allocating the top-up tax.

You can find detailed information about these statements here.

Transitional Simplified Returns

For fiscal years starting no later than 31 December 2028 and ending no later than 30 June 2030, entities can opt for a simplified GIR return if no top-up tax allocation between entities in the jurisdiction is required. This mainly simplifies Statement 4 by allowing aggregation at the jurisdictional level.

Top-Up Tax Payment Statement

The payment statement must include:

- Amounts due under the Income Inclusion Rule (IIR) or Undertaxed Profits Rule (UTPR).

- Any additional national top-up tax due per entity.

- Information required for allocating the top-up tax where applicable.

Implementation of Global Minimum Tax in Australia

Australia implements the OECD Pillar 2 global minimum tax through the Minimum Tax law, which consists of primary and subordinate legislation including:

- Taxation (Multinational—Global and Domestic Minimum Tax) Act 2024

- Taxation (Multinational—Global and Domestic Minimum Tax) Imposition Act 2024

- Treasury Laws Amendment (Multinational—Global and Domestic Minimum Tax) (Consequential) Act 2024

- Taxation (Multinational–Global and Domestic Minimum Tax) Rules 2024 (subordinate legislation)

This legislation aligns with OECD guidance on the GloBE Model Rules and related commentary.

Effective Dates

- The Income Inclusion Rule (IIR) and domestic minimum tax apply from fiscal years starting 1 January 2024.

- The Undertaxed Profits Rule (UTPR) applies from fiscal years starting 1 January 2025.

Scope and Applicability

The rules apply to constituent entities within multinational enterprise groups (MNE groups) whose ultimate parent entity has consolidated annual revenue of €750 million or more in at least two of the previous four fiscal years.

Exclusions

Certain entities are exempted under the law, including government bodies, non-profit organisations, international organisations, some service entities, pension funds, and specific investment funds. Importantly, subsidiaries of excluded entities must be assessed individually for applicability.

You can find detailed information about how the tax is calculated and other important information at the official government website.

Implementation of Global Minimum Tax in New Zealand

New Zealand has enacted the OECD Pillar 2 global minimum tax rules into domestic law, effective for income years beginning on or after 1 January 2025. These rules require in-scope multinational enterprise groups (MNEs) to pay a minimum tax rate of 15% on income earned in each jurisdiction where they operate.

Scope and Effective Date

The rules apply to MNE groups with annual global turnover exceeding €750 million (approx. NZD 1.3 billion) in at least two of the previous four income years.

Key Features

- Complex effective tax rate (ETR) calculations are required, differing from traditional methods.

- If ETR in a jurisdiction is below 15%, a top-up tax is imposed through a hierarchy: Qualified Domestic Minimum Top-up Tax (QDMTT), Income Inclusion Rule (IIR), and Undertaxed Profits Rule (UTPR).

- Safe harbours provide simplified compliance options under certain conditions.

- New Zealand applies a Domestic Income Inclusion Rule (DIIR) (instead of a QDMTT) for New Zealand-headquartered MNEs with low-taxed New Zealand income, effective 1 January 2026.

- Inland Revenue may issue binding rulings on GloBE rule application.

Registration and Compliance

- Constituent entities must register with Inland Revenue within six months after their first in-scope fiscal year.

- If the GloBE Information Return (GIR) is not filed elsewhere with an exchange agreement, it must be filed in New Zealand.

- The Multinational Top-up Tax Return (MTTR) is required regardless of tax liability, with specific filing deadlines.

- Top-up tax payments are due in a single instalment aligned with MTTR deadlines.

- Financial reporting must comply with new requirements under NZ IAS 12 amendments.

Penalties

- Non-compliance can attract penalties up to NZD 100,000.

- Late or incomplete MTTR filing incurs a NZD 500 penalty.

- Additional shortfall penalties may apply.

You can find more detailed information on the official government website.

Implementation of Global Minimum Tax in Singapore (GloBE & DTT)

Singapore is set to implement the OECD Pillar 2 global minimum tax through the introduction of the Income Inclusion Rule (IIR) and a Domestic Top-up Tax (DTT), effective for financial years starting on or after 1 January 2025. The implementation of the Undertaxed Profits Rule (UTPR) will be considered at a later date.

Scope and Applicability

The IIR and DTT apply to multinational enterprise (MNE) groups with consolidated annual revenues of €750 million or more in at least two of the four financial years preceding the application year.

Key Features

- The Income Inclusion Rule (IIR) imposes a top-up tax on the ultimate parent entity for ownership interests in low-taxed constituent entities (LTCEs) with an effective tax rate (ETR) below 15%.

- The Undertaxed Profits Rule (UTPR) acts as a backstop if the parent entity’s jurisdiction does not implement the IIR, allowing other jurisdictions to collect the top-up tax by denying deductions or making equivalent adjustments.

- The Domestic Top-up Tax (DTT) allows Singapore to tax low-taxed profits locally, reducing the top-up tax payable under the IIR or UTPR.

Guidance and Resources

Businesses are encouraged to consult the OECD’s GloBE Model Rules, commentary, and administrative guidance for detailed information on the application of the GloBE Rules and the DTT in Singapore.

You can find more information on the official government website.

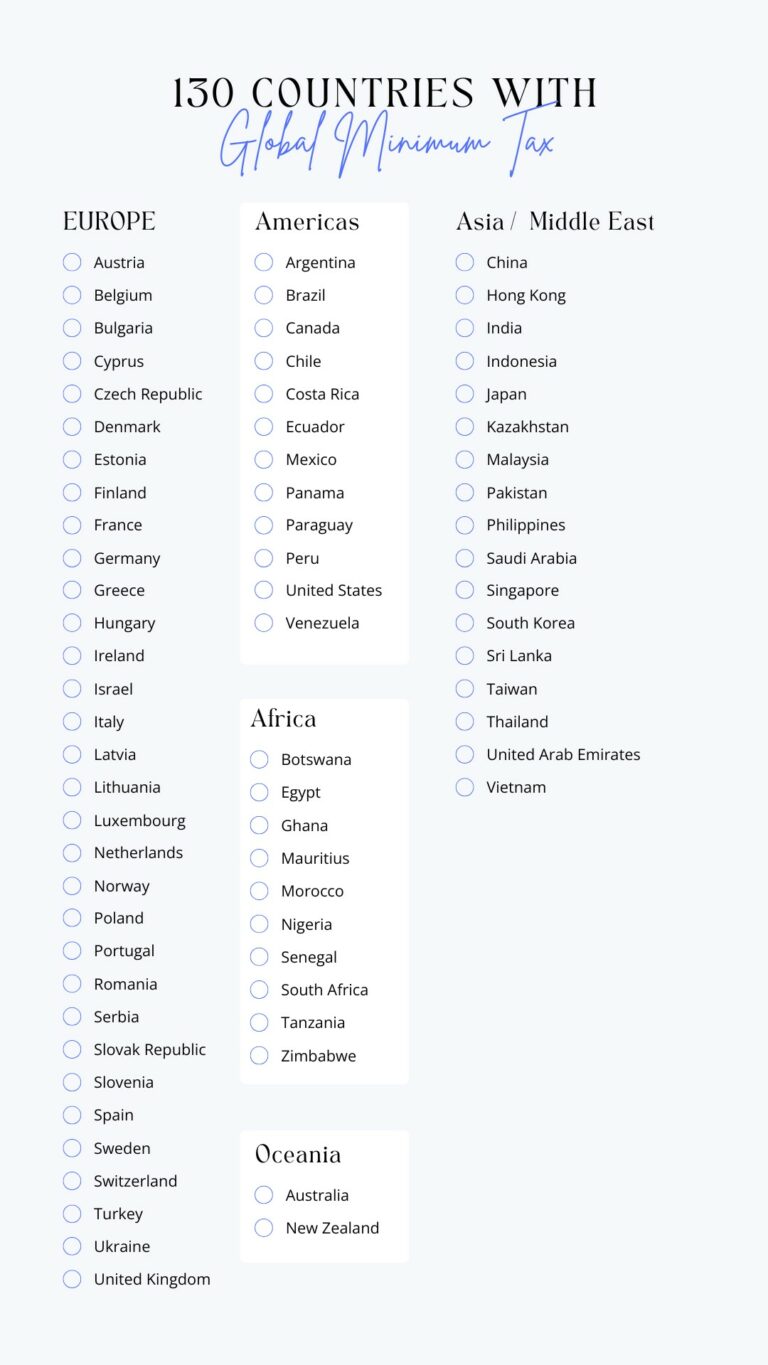

List of Countries With Global Minimum Tax

Here is the list of 130+ countries that have agreed to implement or already implemented the OECD Global Minimum Tax.

The implementation of the OECD Pillar 2 global minimum tax represents a fundamental shift in how multinational enterprises are taxed internationally.

Understanding the nuances of rules such as the Income Inclusion Rule, Undertaxed Profits Rule, and domestic top-up taxes is critical for effective compliance. Early preparation will help businesses mitigate risks, optimize tax planning, and align with the evolving global tax landscape driven by Pillar 2 reforms.

Planning to expand your business to EU? Read why France may be the perfect place to begin.

Or if you have already decided, check out why you should work with local auditors.