The government has introduced a new mandate for e invoicing and e reporting in France that will transform how businesses issue and exchange invoices. Under this system, all VAT-registered companies in France will be required to adopt mandatory e-invoicing in France, replacing paper invoices and simple PDFs with approved structured digital formats. The goal is to improve transparency, simplify tax reporting, and reduce fraud.

This blog explains the key elements of the France e-invoicing requirements, including timelines, invoice formats, the 5-Corner Model, and the role of certified platforms, helping businesses prepare for compliance ahead of the deadlines in 2026 and 2027.

What Is an “Electronic Invoice” Under the French E-Invoicing Mandate?

Under the France e-invoicing mandate, only structured digital formats will be accepted as valid e-invoices in France. Traditional paper invoices or simple PDF files will no longer be sufficient. Businesses must now issue invoices in approved electronic formats that comply with European standards to meet the mandatory e invoicing requirements in France.

The French tax authority (DGFIP) has confirmed formats the following as acceptable formats:

- Factur-X

- UBL 2.1

- CII

- PeppolBIS

- EDIFACT

Timeline for Mandatory E Invoicing in France

The rollout of mandatory e invoicing in France will take place gradually:

- From 1 September 2026: Large companies and mid-cap companies must issue electronic invoices.

- From 1 September 2027: Small and medium-sized enterprises (SMEs) and micro-enterprises must also comply.

The French government has noted that the France e invoicing deadline may be extended by up to six months if necessary.

Scope of E Invoicing in France

The new rules apply to all B2B transactions in France between VAT-registered companies. The e-invoicing requirements in France cover:

- The sale of goods or services in France from one taxable business to another that is not exempt from VAT.

- Advance payments made for these operations.

- Public auctions of second-hand goods, works of art, collectors’ items, and antiques.

New Mandatory Invoice Details

Starting from September 2026 (for large and mid-cap companies) and September 2027 (for SMEs and micro-enterprises), new information must be included on all invoices. These mandatory particulars are:

- The SIREN number of the business.

- The delivery address of the goods (if different from the customer’s address).

- An indication of whether the invoice relates solely to goods, solely to services, or to a mix of both.

- A note if VAT is payable on a debit basis, where the supplier has opted for this regime.

Business Obligations Under the French E Invoicing Mandate

In addition to domestic invoices, companies must also comply with e reporting requirements in France by transmitting the following to the tax authority in near real-time:

- Cross-border B2B invoices (imports and exports).

- B2C receipts (domestic and cross-border).

- Payment statuses for B2B and B2C service transactions.

Unlike domestic B2B invoices, which must follow a structured format, these cross-border and B2C documents can still be issued as PDFs or other formats. However, the transaction data must still be reported in a structured format.

Securing and Preserving Electronic Invoices

To ensure compliance and authenticity, the 2023 French Finance Law authorizes the use of qualified electronic seals. This seal serves three purposes:

- Guaranteeing the authenticity of the origin of the invoice.

- Ensuring the integrity of the content.

- Preserving the legibility of the document.

In practice, the seal certifies that the invoice was created by the legitimate issuer.

Additionally, French law requires that all electronic documents, including invoices, must be kept in electronic format for ten years, starting from the date of issuance.

Transition to the 5-Corner Model

The 5-Corner Model Explained

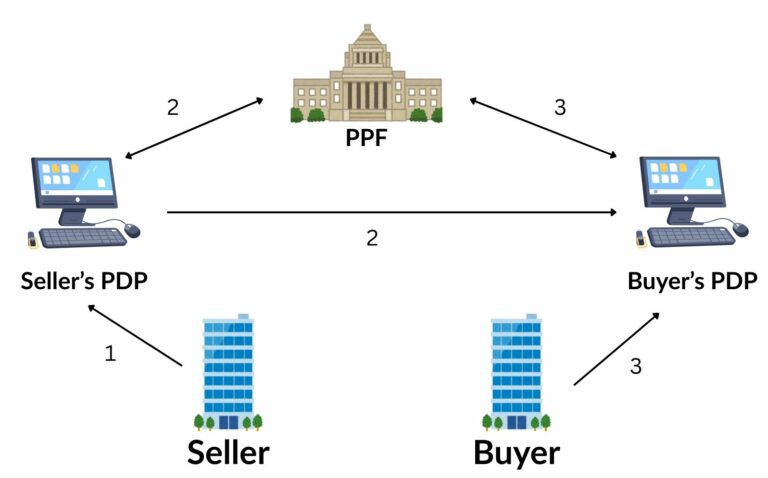

Here’s how the 5-Corner Model works:

- The supplier (seller) creates an invoice.

- Instead of sending it straight to the buyer, the invoice first goes to the supplier’s PDP (Partner Dematerialization Platform).

- The buyer also has a PDP, which receives the invoice on their behalf.

- While passing through the PDPs, the invoice data is also reported to the French government’s platform (PPF) for tax purposes.

- If the buyer doesn’t have a PDP, the PPF itself forwards the invoice to them.

That’s why it’s called a 5-corner model.

How It Differs from Other Models

There are 3 kinds of traditional models that can be used for invoicing

- Interoperability Model: Businesses exchange e-invoices through their service providers, who interconnect with others. This promotes flexibility but offers limited tax authority oversight.

- Centralized Model: All invoices pass through a single government platform, giving tax authorities full visibility but leaving less room for private-sector innovation.

- Decentralized Model (CTC-based): Certified service providers validate and transmit invoices to both trading partners and the tax authority. This shifts responsibility from the government to private providers.

The 5 corner model is essentially a hybrid that makes sure invoices move securely between companies while the tax office automatically gets the information it needs, without businesses having to send it twice.

This structure places significant responsibility on service providers, while reducing the administrative load on the tax authority. By relying on PDPs for invoice distribution and compliance reporting, the government ensures consistency, while businesses benefit from the innovation and automation offered by the private sector.

Role of Peppol and DCTCE

Peppol is an international network for exchanging e-invoices and other business documents. It traditionally follows a 4-corner model, where service providers (Access Points) send invoices in the Peppol BIS format. While Peppol is mandatory in some European countries, in France it is being adapted into a more advanced CTC (Continuous Transaction Controls) model.

This upgraded system, also known as the Decentralized CTC and Exchange (DCTCE) model, ensures that transaction data is reported in real time to the tax authority. France’s approach combines this decentralized model with centralized elements, creating a unique hybrid system for mandatory e-invoicing and e-reporting in France.

You can read more about their functioning and country specific requirements here.

Role of PDPs

To meet the mandatory e invoicing in France, businesses must work with a certified Partner Dematerialization Platform (PDP). The role of PDPs include:

- Transmitting e-invoices and lifecycle statuses to the government platform (PPF).

- Exchanging invoices between PDPs:

- If both parties use different PDPs, the issuing PDP forwards the invoice to the recipient’s PDP and reports required data to the PPF.

- If the recipient does not use a PDP, the issuing PDP sends the invoice to the PPF, which then transmits it to the buyer.

- Facilitating e reporting in France by transmitting cross-border B2B and domestic B2C transactions to the PPF.

- Converting e-invoices into one of the three mandatory formats to ensure compliance with European standards.

Companies can use different PDPs for different tasks, depending on their needs. Some PDPs cover both e invoicing and e reporting, offering greater flexibility.

Compliance Steps for Companies in France

- Choose a certified PDP (Partner Dematerialization Platform).

You can’t send invoices directly to the state platform (PPF). You must go through a PDP, which will handle sending, receiving, and reporting invoices on your behalf. - Issue invoices in the required structured formats.

From the France e-invoicing deadline (Sept 2026/2027), invoices must be in one of the three approved formats as mentioned above. - Send and receive all domestic B2B invoices electronically.

This includes standard invoices, self-billed invoices, prepayments, corrections, and credit notes. - Report extra transactions to the tax authority.

You must also e-report: Cross-border B2B invoices (imports/exports), B2C receipts (domestic and international), Payment statuses for service transactions.

These can be issued as PDFs, but the data must be reported electronically in structured form. - Include new mandatory information on invoices.

Such as the SIREN number, delivery address, transaction type (goods, services, or both), and VAT details if applicable. - Archive e-invoices electronically for 10 years.

All invoices must be stored in digital form and remain accessible for audits.

Extra Material

Detailed FAQ – The DGFiP has published an extensive FAQ designed to answer frequent questions regarding Partner Dematerialization Platforms (PDPs). This resource is key for understanding the updated requirements and ensuring adherence to regulations.

Guidance for SMEs and Micro-Enterprises – Updated information sheets specifically aimed at SMEs and micro-enterprises are now available. These documents offer important guidance on how smaller businesses can meet the new e-invoicing obligations.

Complying with the mandatory e-invoicing in France may seem complex at first, but the system is designed to streamline invoice processing and reporting for businesses while giving tax authorities real-time visibility. By understanding the French e-invoicing requirements, adopting certified PDPs, and issuing invoices in approved formats, companies can ensure smooth operations, avoid penalties, and take advantage of the efficiency offered by digital invoicing.

Preparing early is key: companies that adapt their systems before the France e-invoicing deadlines will have a significant advantage in managing B2B and cross-border transactions efficiently.

Need help with accounting and auditing for your business in France? Contact us today!