As climate change and corporate accountability take center stage globally, Australia has taken a bold step forward by introducing its own Australian Sustainability Reporting Standards (ASRS). These new standards, AASB S1 and AASB S2, aim to bring transparency, consistency, and global alignment to how businesses report on environmental and sustainability risks.

Whether you’re a listed company, a large private enterprise, or a sustainability professional, understanding these standards is now essential. Built on the backbone of the IFRS® Sustainability Disclosure Standards, AASB S1 and AASB S2 are set to shape the future of sustainability reporting in Australia, providing a clear framework for disclosing everything from governance and risk to climate targets and emissions.

In this article, we break down the purpose and key requirements of both standards and offer practical guidance to help organizations prepare for this new era of sustainability reports.

What are the Australian Sustainability Reporting Standards (ASRS)?

The ASRS comprises of two parts:

- AASB S1 – General Requirements for Disclosure of Sustainability-related Financial Information:

These disclosures are voluntary under ASRS and are developed with IFRS S1 as a guide.

- AASB S2 – Climate-related Financial Disclosures:

These disclosures are mandatory and target the climate risks and opportunities as under IFRS S2 with some differences.

Both standards were approved in September 2024, embedded in Australian law via the Treasury Laws Amendment Act 2024 and overseen by the Australian Accounting Standards Board (AASB).

What is AASB S1?

AASB S1 – General Requirements for Disclosure of Sustainability-related Financial Information is part of the Australian Sustainability Reporting Standards (ASRS) and is based on the IFRS® Sustainability Disclosure Standard S1.

It sets out the principles and framework for reporting sustainability-related financial information across a range of environmental, social, and governance (ESG) topics, not just climate.

Key Features of AASB S1

- These standards apply to all sustainability-related risks and opportunities that are material. This includes anything that could reasonably impact a company’s cash flow, cost of capital, or access to finance.

- Requires disclosures across:

- Governance: oversight of sustainability matters.

- Strategy: identification of sustainability risks/opportunities and their business impact.

- Risk Management: integration of sustainability into enterprise risk frameworks.

- Metrics and Targets: how entities measure, monitor, and track progress.

What is the effective date for AASB S1?

AASB S1 is voluntary from 1 January 2025. Entities can choose to adopt it if they want to go beyond climate-specific reporting under AASB S2.

How is AASB S1 different from IFRS S1?

- Materiality lens: Both use investor-focused financial materiality, but AASB S1 provides additional guidance tailored for not-for-profit and public sector entities in an Australian context.

- Local legal references: AASB S1 replaces some global references (like SEC or US regulations) with Australian legislative equivalents.

- More flexible assurance expectations: Since it’s voluntary for now, there’s no mandatory assurance requirement under AASB S1.

What is AASB S2?

AASB S2 – Climate-related Financial Disclosures is the mandatory standard under the ASRS framework that governs how companies report on climate-related risks, opportunities, and emissions.

It is adapted from IFRS S2, developed by the International Sustainability Standards Board (ISSB), and comes into effect in Australia from 1 January 2025 for large (Group 1) entities.

Key Features of AASB S2

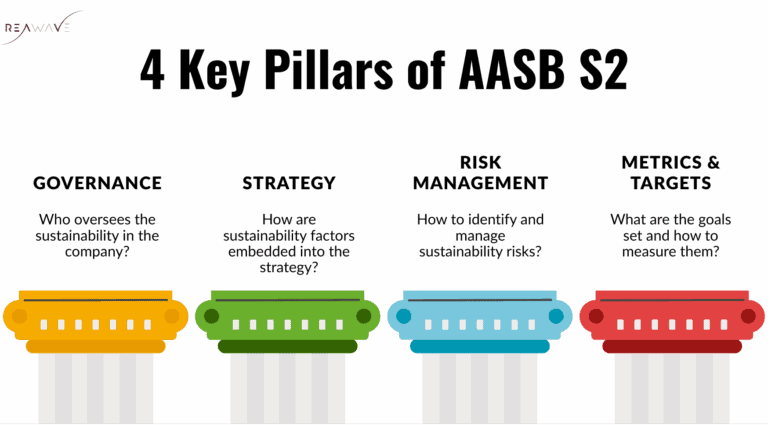

- AASB S2 requires companies to disclose climate-related information under four pillars:

- Governance – Board and management roles, oversight processes, and climate expertise.

- Strategy – Business impacts of climate risks, scenario analysis, and transition planning.

- Risk Management – Climate risk integration into broader risk systems and processes.

- Metrics and Targets – Disclosure of Scope 1, Scope 2, and (from year 2) Scope 3 greenhouse gas emissions, targets, and performance tracking. More about this further in the article.

- It also mandates forward-looking disclosures such as climate resilience scenarios, internal carbon pricing, and financed emissions (for financial institutions).

What is the effective date for AASB S2?

- It is mandatory for Group 1 entities from Jan 2025.

- Gradual rollout to Group 2 (from Jul 2026) and Group 3 (from Jul 2027) based on size and industry classification.

You can find more information about this here.

How is AASB S2 different from IFRS S2?

- SASB Metrics Omitted: While IFRS S2 incorporates SASB industry-specific metrics, AASB S2 does not adopt these directly. Instead, it encourages entities to choose relevant metrics aligned with their own sector and risk exposure.

- Local alignment: AASB S2 removes references to international frameworks not applicable in Australia (e.g., US climate regulations) and includes links to Australian law and regulators (e.g., ASIC, Treasury).

- Scope 3 & Liability Relief: AASB S2 introduces transitional reliefs around Scope 3 reporting and scenario analysis, easing the burden on companies new to this kind of disclosure.

What are Scope 1, 2 & 3 Emissions under AASB S2?

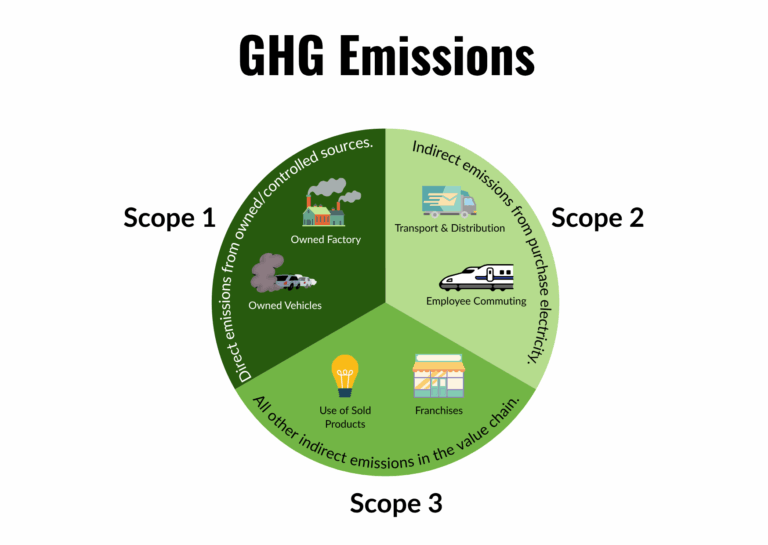

Understanding Scope 1, 2, and 3 emissions is central to effective sustainability reporting under frameworks like AASB S2 and the IFRS® Sustainability Disclosure Standards. These categories help organizations measure their greenhouse gas (GHG) emissions across the full value chain, directly and indirectly.

Scope 1 – Direct Emissions

Scope 1 emissions are direct GHG emissions that come from sources a company owns or controls.

These typically include:

- Emissions from on-site fuel combustion (e.g. gas boilers, furnaces)

- Emissions from company-owned vehicles (e.g. trucks, vans, service cars)

- Industrial process emissions

Example: A manufacturer running gas-fired machinery on-site would report those emissions as Scope 1.

Scope 2 – Indirect Emissions from Purchased Energy

Scope 2 emissions are indirect emissions from the generation of energy that the company purchases and consumes, such as electricity, steam, heating, or cooling.

Even though the company doesn’t produce these emissions directly, it is responsible for them because it uses the energy.

Example: An office that uses grid electricity contributes to emissions at the power plant.

Scope 3 – Other Indirect Emissions from the Value Chain

Scope 3 emissions are all other indirect GHG emissions that occur outside a company’s own operations but are still linked to its activities.

This includes both:

- Upstream activities: e.g. purchased goods and services, transportation, waste, business travel

- Downstream activities: e.g. product use, end-of-life treatment, investments

Scope 3 is typically the largest and most complex category and often makes up the majority of a company’s total carbon footprint.

Example: The emissions from raw materials used by a supplier, or from a customer using a company’s product, fall under Scope 3.

Practical Steps for Implementation of ASSB Standards

- Conduct a gap analysis: First, you need to assess current ESG data practices against ASRS requirements. This will help you understand what extra information you need and what needs to be modified.

- Establish governance: Assigning board and management accountability for sustainability reporting will ease in preparation of reports.

- Set up risk and emissions frameworks: Adopt systems to measure, manage, and disclose Scope 1–3 GHG emissions.

- Plan for assurance readiness: Prepare for phased assurance from limited to reasonable by 2030.

The Australian Sustainability Reporting Standards (ASRS), the AASB S1 and AASB S2, offer a structured pathway for organizations to communicate sustainability efforts transparently and credibly.

Early planning and implementation not only ensure compliance but also enhance investor confidence and align Australian reporting with evolving global standards. If your organization hasn’t started yet, now is the time to assess readiness and begin the journey towards transparent, integrated sustainability reporting.