Doing business in France offers foreign and multinational companies a unique opportunity to access one of Europe’s largest, most diversified, and innovation-driven economies. Known for its central location in the EU, strong infrastructure, and skilled workforce, France continues to rank as a top destination for foreign direct investment.

In this blog, we’ll explore not only the benefits of doing business in France but also the practical steps to setting up a company in France, including key regulatory considerations, local expectations, and tips for navigating French cultural differences.

Whether you’re planning to expand or just getting started, this guide will help you make informed decisions and avoid common pitfalls.

Advantages of Doing Business in France

Here are some reasons why expanding to France makes strong business sense for companies in the APAC region.

Leading Destination for Foreign Investment

France has been the top destination in Europe for foreign direct investment for six years running. In 2024, France attracted 1,025 projects, representing 19% of total foreign investment in Europe, outpacing Germany and the UK.

In 2023, it also welcomed 1,194 projects, which is equivalent to around one in five across Europe.

Major Investment Commitments from Leading Corporations

At the “Choose France” summit, global corporations announced over €15 billion in new investment, including Microsoft’s €4 billion AI & cloud project and Amazon’s €1.2 billion infrastructure expansion.

These commitments are projected to support approximately 10,000 new jobs.

Strong Industrial & Sectoral Appeal

Industrial projects make up nearly half of investment activity in France. In 2024, 415 industrial projects were launched—the highest number in Europe. France is a leader in innovation, consistently ranking first for EU investment in AI and quantum technologies, and second for R&D projects, with 104 new EU-stage R&D investments in 2024.

Innovation-Friendly Environment & Generous R&D Support

France ranks among the top five OECD countries for R&D spending. It was 7th globally in 2022 and 3rd in Europe—the world-class R&D tax credit (CIR) covers 30% of R&D expenditure up to €100 million.

Strategic Market Access & Infrastructure

As the 7th-largest economy globally, France is a compelling hub for serving both European and African markets. Its transport infrastructure is world-class: the second-longest railway network in Europe, leading EU airports, and high-speed internet coverage in over 51% of the country.

Sustainable & Regional Appeal

Foreign investment is not confined to Paris, about 75% of projects take place outside Île-de-France. Many are also focused on decarbonization and green industries, aligning with national goals under the France 2030 strategy.

Competitive Tax System for Businesses

France has made major strides in reducing its corporate tax burden to attract international businesses. As of 2024, the standard corporate income tax rate has been lowered to 25%, aligned with the EU average and more competitive than Germany (30%+) or Italy (27.8%).

In addition to its 30% R&D tax credit (one of the most generous in Europe), France offers:

- Young Innovative Company (JEI) status, with corporate and payroll tax exemptions

- Full participation exemption on dividends and capital gains from qualifying subsidiaries

- Reduced VAT compliance burdens for foreign businesses via reverse-charge mechanisms

These measures, combined with ongoing digitization of tax reporting and support from dedicated investor desks, position France as a fiscally attractive location for long-term expansion.

What Foreign Companies Should Know Before Doing Business in France

Respecting French Business Culture and Communication Norms

Understanding French cultural differences is key to building long-term relationships and trust in the local market.

French business culture often values formality, hierarchy, and a clear distinction between professional and personal life. Greetings typically include formal titles, and meetings may follow structured agendas. Business communication tends to be more direct and detail-oriented than in some other cultures.

As a foreign company in France, adapting to these norms will help you avoid misunderstandings and demonstrate your commitment to working respectfully within the local environment.

Knowing How French Businesses Make Decisions

In France, business decision-making tends to be methodical and consensus-driven, especially in larger corporations. Senior executives and top-level managers are often heavily involved in the evaluation process, which means your sales cycles may be longer and more analytical than in markets where agility is prioritized.

To succeed in doing business in France, your sales team must understand these dynamics and adjust their strategy accordingly: identify the true decision-makers, prepare comprehensive proposals, and build a strong business case supported by logic and performance data.

Adapting to French Buyer Preferences and Channels

When expanding into France, there is another set of french cultural differences it is essential to understand – how local customers prefer to interact with brands. This includes identifying the marketing channels they trust, the types of content they consume, and their buying behavior.

Whether you’re in B2B or B2C, localizing your outreach, both linguistically and culturally, can significantly improve your success rate.

Thus, conduct market research, interview target customers, and align your messaging to meet the expectations of a French audience. This insight will also help your sales and marketing teams better position your product or service within the local competitive landscape.

Building a Tailored Local Market Strategy

Success in France requires more than translating your website or product materials. It means creating a localized business strategy that reflects the country’s regulatory environment, tax obligations, customer expectations, and distribution channels.

When setting up your foreign company in France, consider whether you’ll operate as a subsidiary, branch, or through a non-established entity, each with its own accounting and compliance implications. You can read more about the requirements for non-established entities here and an established entity on their dedicated blogs.

Having a clear go-to-market plan that addresses local hiring, pricing, legal formalities, and even after-sales service will make your expansion more effective and sustainable.

How to setup a business in France

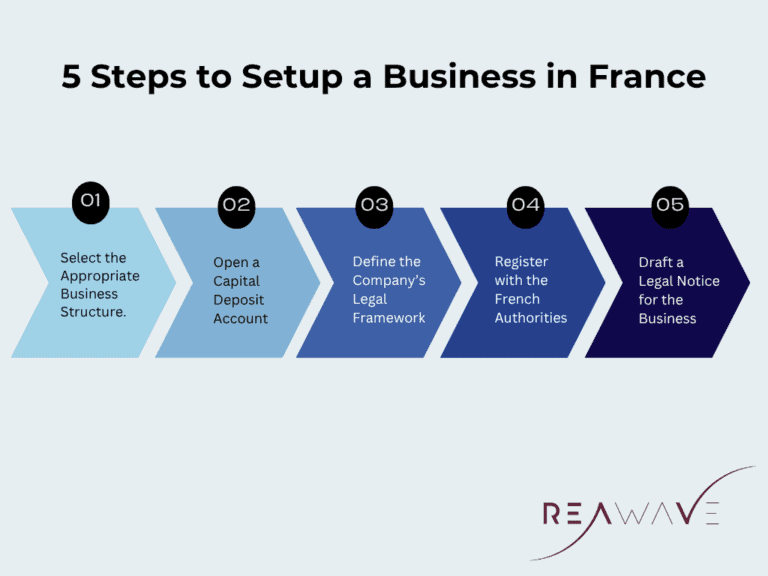

To set up a company in France, there are five key administrative steps every foreign business must complete:

1. Select the Appropriate Business Structure

Begin by choosing the legal form that best suits your activities, such as a SARL, SAS, or branch, based on liability, ownership, and operational needs. You can read more about business structures on its dedicated blog on our website.

2. Define the Company’s Legal Framework

Choose your company’s legal status and prepare core documents like the articles of association, shareholder agreements, and internal governance rules.

3. Open a Capital Deposit Account

Place the required initial capital into a temporary bank account in France. A certificate of deposit will be needed to proceed with registration.

4. Register Your Business with French Authorities

File your completed incorporation documents with the relevant Business Formalities Centre (CFE) to obtain your company’s SIRET number and official registration.

5. Draft a Legal Notice for Your Business

Prepare a formal announcement that outlines the basic details of your new company. This will be published in an official legal journal.

Doing business in France can open doors to one of Europe’s most strategic and opportunity-rich markets. However, success in setting up a company in France depends on understanding local expectations, legal requirements, and cultural nuances.