Labour law in France is known for being both comprehensive and protective of employee rights. For international companies entering the French market, understanding these regulations is critical, not only to ensure legal compliance, but also to build trust with the local workforce.

Whether you’re setting up a branch, a subsidiary, or hiring remote staff in France, you must navigate a complex legal landscape that governs everything from working hours and contracts to paid leave and termination procedures.

In this guide, we’ll break down the key aspects of French work law relevant to foreign businesses. Whether you’re hiring your first French employee or expanding an existing team, this blog will help you understand the legal essentials and avoid common pitfalls.

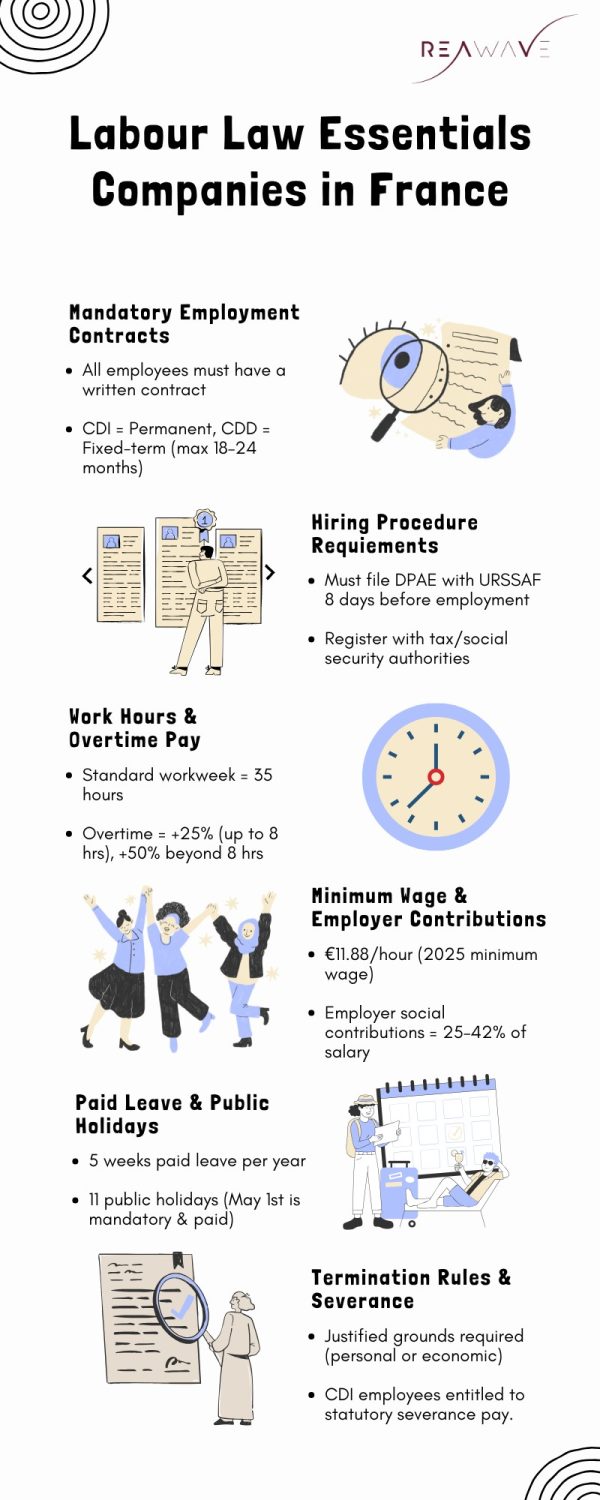

If you want a summary of all the important points, you can find them here.

Le Code du Travail : The French Labour Code

The French Labour Code, known as “Le Code du Travail” outlines the rights and obligations of both employers and employees.

This code covers a wide range of topics including minimum wage, French working hours law, termination procedures, overtime pay, vacation period etc.

Types of Employment Contracts in France

There are two main types of employment contracts in France – CDD & CDI.

CDD or contrat de travail à durée déterminée is a fixed duration contact. Usually, the maximum duration is 18 months, but this can be extended to 24 months under certain conditions.

CDI or contrat de travail à durée indéterminée is a permanent contact without any specific end date. A CDI can be part-time or full-time and the working hours and conditions are specified in the contract.

This also means that if an employee wants to quit, they need to give appropriate notice as stated in the contract. Similarly, an employer wishing to terminate the contract needs to respect the termination protocols and demonstrate grounds for dismissal.

Hiring Procedure Requirements

Hiring employees in France involves several legal and administrative steps to ensure compliance with French labour law. Whether you’re a foreign company establishing a presence or hiring remote workers, the following requirements apply:

- Drafting a compliant employment contract that includes, among other things, the job title and description, working hours, duration, notice periods and probation if any.

- Before any employee starts working, the employer must submit a Déclaration Préalable à l’Embauche (DPAE) to URSSAF (the social security collection agency). This declaration must be filed at least 8 days before the employee’s start date.

- Register with social and tax authorities. You can find more details about these requirements for an established firm here and a non-established firm in their dedicated blogs.

- All new hires must undergo an initial medical check with an occupational health service within three months of starting work. Additionally, employers are also required to maintain workplace safety standards and documentation under French employment law.

Working Hours, Overtime, and Paid Leaves

Working Hours and Breaks in France

Under French labour law, the standard workweek is 35 hours, though this can vary by industry and collective agreements. Any hours worked beyond this threshold are classified as overtime and must be compensated accordingly.

Employees are entitled to a minimum 20-minute break. Longer lunch breaks (around 1 hour) are common in many French workplaces, often as part of company culture or collective agreements.

Paid and Unpaid Leaves in France

Under French labour law, full-time employees working 35 hours per week are entitled to five weeks of paid leave per year, earned at a rate of 2.5 days per month worked, up to a maximum of 30 days.

Leave is calculated from 1 June to 31 May each year. Unless otherwise agreed, employees cannot take more than 24 days consecutively and must take at least 12 consecutive days between 1 May and 31 October.

Unused leave generally cannot be carried over to the next year unless special arrangements are made. Leave entitlements for part-time staff are calculated on a pro-rata basis.

Maternity and Paternity Leave

French labour law provides generous leave for new parents. Maternity leave generally ranges from 8 to 16 weeks, increasing in cases of multiple births or high-risk pregnancies. For example:

- 26 weeks for mothers with two dependent children

- 34 weeks for twins

- 46 weeks for triplets

Maternity pay is based on average earnings from the three months prior to leave, capped at the social security ceiling.

Fathers are entitled to 28 days of paternity leave, extended to 32 days for multiple births. Employers cover the first three days, while the rest is paid by social security.

Sick Leave and Pay

In France, sick pay is covered by the social security system, not the employer. From the fourth day of absence, employees can receive up to 50% of their average daily wage, with payments lasting up to three years, provided a valid medical certificate is submitted.

Public Holidays in France

France observes 11 national public holidays, with two additional ones specific to Alsace and Lorraine. Among these, only May 1st “Fete du Travail” (International Workers’ Day) is a mandatory paid holiday. If employees work on this day, they are typically entitled to double pay.

Compensation and Social Security Contributions

The URSSAF updates the minimum wage requirement every year. As of 1st January 2025, the minimum wage is €11.88/hour. For overtime up to 8 hours, an additional 25% and beyond 8 hours of overtime is 50% premium needs to be paid.

Additionally, in France, employers are required to contribute to the social security system, which funds healthcare, unemployment benefits, pensions, and family allowances.

Contribution rates vary based on factors such as the employee’s gross salary, the nature of the contract, and the company’s industry sector. These charges can represent a significant portion of payroll costs, typically ranging between 25% and 42% of gross salary.

Employers must also ensure timely declarations and payments to avoid penalties.

Termination, Resignation, and Retirement

Termination of Employment

The labour law in France enforces strict rules that prioritize employee protection. Terminating an employee must follow legally defined procedures and be based on legitimate grounds.

Legal Grounds for Dismissal:

- Employers can only terminate employment for “just cause”, which typically falls under two categories:

- Personal grounds – such as misconduct, poor performance, or absenteeism.

- Economic grounds – including financial hardship, restructuring, or job eliminations.

Notice Requirements:

- Employers must give prior notice unless they opt to pay compensation in lieu.

- The length of the notice period depends on:

- The employee’s seniority.

- Terms specified in the employment contract.

- Applicable collective bargaining agreements.

Dispute Procedure:

- Employees have 15 days from receiving the dismissal notice to challenge the decision in France’s Labour Court (Conseil de Prud’hommes).

Resigning from Employment

Employees who choose to leave voluntarily must:

- Follow the notice period outlined in their employment contract.

- Submit a formal letter of resignation.

- Receive written confirmation from the employer acknowledging the termination.

While there’s flexibility in the resignation process, following protocol helps avoid disputes.

Collective Redundancies

When laying off multiple employees, additional steps are required:

- Employers must consult with employee representatives.

- A social plan (Plan de Sauvegarde de l’Emploi) is mandatory to support affected employees, including retraining or relocation assistance.

- Redundancies must comply with detailed procedural steps to avoid litigation or financial penalties.

Severance Pay Obligations

Employees dismissed under an indefinite-term contract (CDI) are entitled to statutory severance:

- For up to 10 years of service:

25% of the gross monthly salary × number of years worked. - For over 10 years of service:

33.33% of the gross monthly salary × number of years worked.

Note: Some companies may offer more generous terms through internal policy or collective agreements.

Trade Unions and Collective Bargaining in France

Trade unions play a central role under the labour laws in France, advocating for employee rights and negotiating employment conditions. Their influence is significant even in non-unionised workplaces.

Key Roles of Trade Unions

- Representation: Unions act on behalf of employees in discussions with employers, focusing on improving wages, working hours, and workplace safety.

- Collective Bargaining: They negotiate legally binding agreements that define employment terms beyond the minimum legal standards.

Types of Agreements

- Company-Level Agreements (Accords d’Entreprise): Tailored to individual companies.

- Industry-Level Agreements (Conventions de Branche): Apply across entire sectors.

Over 95% of workers in France are covered by such agreements, making it essential for foreign businesses to understand and align with them.

Understanding labour law in France is essential for any international company operating in France. From hiring practices to working hours, compliance with the country’s detailed legal framework ensures smooth business operations and protects employee rights.