In today’s digital economy, data has become one of the most valuable assets. Consumers generate large amounts of personal and transactional information every day and having greater control over this data is essential for both transparency and competition.

To address this need, Australia introduced the Consumer Data Right (CDR) Legislation, a legal framework that gives individuals and businesses more power over how their data is accessed and shared.

This blog discusses what CDR is, what is classified as CDR data, and how data is shared under the legislative’s rules.

What is CDR? (CDR meaning)

The definition of CDR data is set out in a sector’s designation instrument. Each sector covered by the framework, such as banking, energy, or telecommunications, has its own instrument that specifies what information qualifies as CDR data.

The meaning of CDR data is deliberately broad. It not only covers the direct data listed in the designation instrument but also extends to data that is derived wholly or partly from that information. This includes data that has been further derived from previously generated datasets.

Materially Enhanced Information

Within the legislation, there is also the concept of “materially enhanced information.” This refers to product usage data that becomes more valuable, insightful, or commercially significant once it has been analysed.

Since CDR rules state that derived information is still considered CDR data, materially enhanced insights are also covered. In banking, this could include the results of an income or expense assessment, or the classification of transactions into categories such as rent, groceries, or entertainment. These insights, while not raw transaction data, are treated as part of the consumer’s CDR data because they directly stem from the original dataset.

What is Not Considered CDR Data?

While the CDR gives consumers control over a wide range of personal and product information, not all data falls under its scope. In the banking sector, for example, certain categories of credit-related information, which are already regulated under the Privacy Act, are excluded from the definition.

According to section 9 of the designation instrument for banking, exclusions include:

- a statement that an information request has been made for an individual by a credit provider, mortgage insurer or trade insurer

- new arrangement information about serious credit infringements

- court proceedings information about an individual

- personal insolvency information about an individual

- the opinion of a credit provider that an individual has committed a serious credit infringement.

De-Identifying CDR Data

Under the legislation, accredited data recipients can “de-identify” information, meaning that it can no longer be used to reasonably identify a consumer, even when combined with other available data. De-identification must follow strict processes set out in the legislation.

De-identification may be carried out in order to:

- Comply with Privacy Safeguard 12 by removing data that is no longer needed (as an alternative to deletion).

- Use the data for research purposes, provided the consumer has given explicit consent.

- Share or sell de-identified data to a third party, again only with the consumer’s express consent.

How CDR Data is Shared

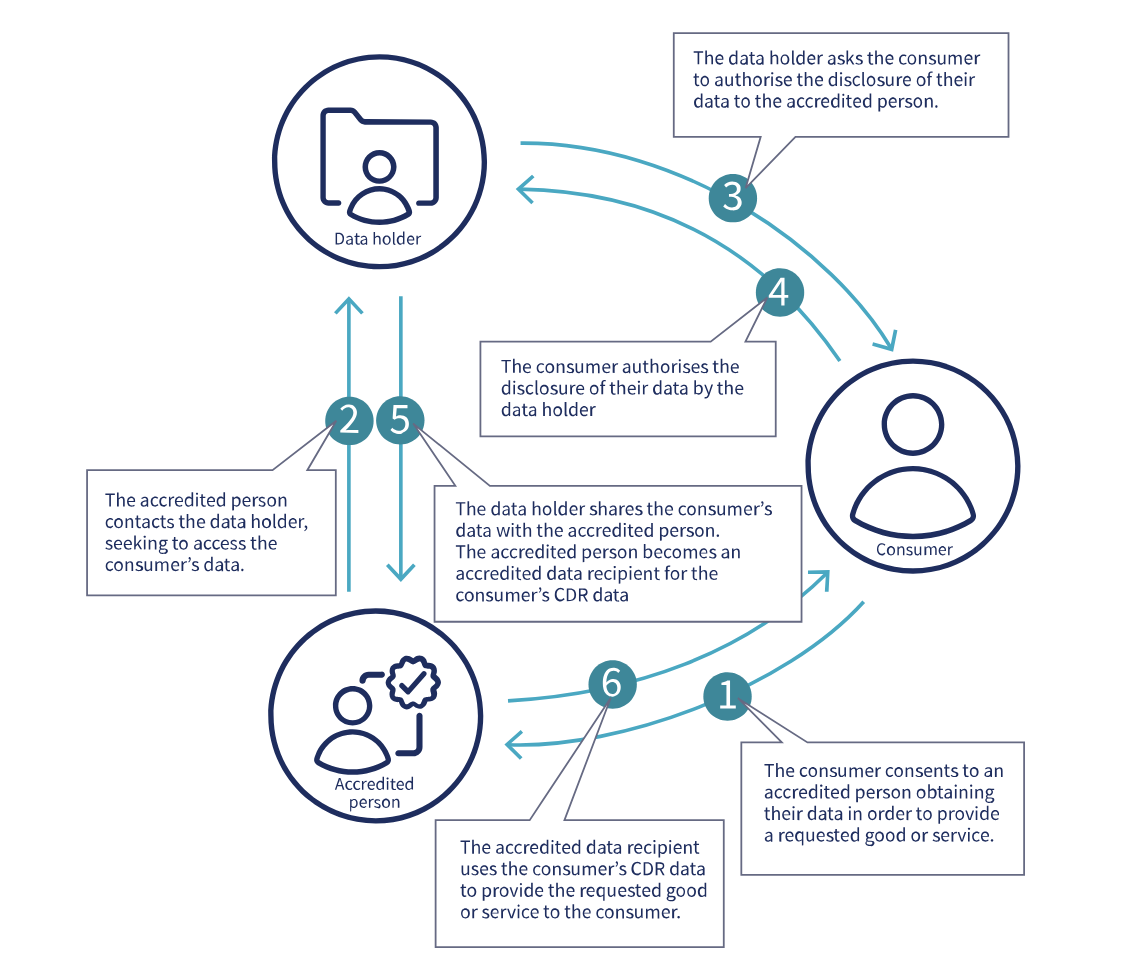

The process typically unfolds in six steps:

- Consumer Consent

The consumer agrees to share their data with an accredited provider in order to access a specific good or service. - Accredited Person Requests Access

The accredited provider (for example, a fintech or energy comparison service) contacts the data holder, such as a bank or utility company, to request the consumer’s information. - Data Holder Seeks Authorisation

The data holder asks the consumer to confirm that they want their data disclosed to the accredited provider. - Consumer Authorises Disclosure

The consumer formally authorises the transfer of their data, ensuring that the process is voluntary and transparent. - Data Transfer

The data holder securely shares the requested information with the accredited provider. At this stage, the provider becomes an accredited data recipient of the consumer’s CDR data. - Service Delivery

The accredited data recipient uses the consumer’s data to deliver the agreed service, such as providing tailored product recommendations, financial tools, or energy plan comparisons.

What Businesses Need to Know

The CDR establishes a detailed framework that businesses must follow in order to participate. Key considerations include:

Compliance Requirements

Businesses designated as data holders must be prepared to share data when requested by consumers. They must ensure their systems are secure, reliable, and capable of handling data transfers in line with the legislation.

Accreditation Process

To receive CDR data, businesses must apply to become an Accredited Data Recipient (ADR). Accreditation is managed by the Australian Competition and Consumer Commission (ACCC) and requires organisations to meet strict conditions around information security, privacy management, and operational capacity. This accreditation demonstrates that the business is trusted to handle sensitive consumer information.

Data Security and Privacy Obligations

Accredited businesses must comply with the privacy safeguards outlined in the CDR rules. These safeguards are stricter than the general privacy principles under the Privacy Act, reflecting the sensitive nature of the data.

Opportunities for Businesses

While compliance involves effort and cost, it creates significant opportunities:

- Innovation: Access to richer consumer data allows businesses to design more personalised and competitive products.

- Trust: Transparency in how data is handled strengthens consumer confidence.

- Competitiveness: Early adoption of CDR practices positions businesses to stay ahead in a changing digital economy.

The Future of CDR in Australia

The Consumer Data Right is still evolving, and its reach will expand well beyond banking and energy. Understanding its future direction is vital for businesses planning long-term strategies.

Expansion Into New Sectors

The Australian Government has signaled plans to extend CDR. This will give consumers even greater visibility across their financial and service-related data, creating a more connected and competitive marketplace.

Towards a Data Economy

The broader vision of this legislation is to build a dynamic “data economy” where information flows safely and efficiently between consumers and service providers. In this environment, businesses can leverage insights responsibly while consumers maintain control.

International Comparisons

Australia’s CDR rules are often compared to “Open Banking” initiatives in the United Kingdom and Europe. While those frameworks began with financial data, Australia’s approach is more ambitious as it is designed to eventually cover multiple sectors of the economy. This cross-industry reach positions Australia as a global leader in consumer-driven data rights.

The Consumer Data Right (CDR) represents a major step toward a fairer and more transparent digital economy in Australia. By giving individuals and businesses control over their information, the framework not only strengthens consumer trust but also creates new opportunities for innovation and competition.

For companies, understanding the rules and meeting compliance obligations is essential, not just to stay compliant, but also to stay competitive in a rapidly evolving market.